A flexible charge card that blends everyday practicality with unmistakably premium touches can be hard to find.

The American Express® Green Card issued in Japan manages that balance through globally usable spending power, layered lifestyle benefits, and a step‑by‑step online application that anyone can complete in minutes.

This guide equips you to decide whether the card fits your wallet and then walks you through the exact process for securing approval—no jargon, no fluff, just clear instructions you can act on today.

Why the AMEX Green Japan Credit Card Deserves a Look

A short orientation helps you evaluate the card’s strongest points before diving into the finer details. Expect to see practical features that serve daily needs alongside value‑adds that feel distinctly premium.

- Membership Rewards® points on every eligible purchase keep your earning steady year‑round.

- Green Offers™ dining and hotel privileges elevate routine nights out or weekend stays without extra effort.

- Optional ETC (Electronic Toll Collection) companion card handles expressway fees nationwide and streamlines road trips.

- Worldwide acceptance through American Express means you can confidently tap, swipe, or touch‑free pay across borders.

- Responsive customer service and purchase protections stand ready when plans shift unexpectedly.

Those benefits position the Green Card as an accessible entry point into the AMEX ecosystem while still delivering perks seasoned cardholders respect.

Key Figures: Fees, Rates, and Costs

Understanding the price of ownership allows transparent comparisons against rival cards. Keep these numbers in mind while weighing value against annual spending habits.

- Monthly basic fee: ¥1,100 (tax included).

- Family card fee: ¥550 per additional card each month.

- ETC card annual fee: ¥550 per unit.

- Late payment interest: 3.5 percent annually on unpaid balances.

- Cash advance APR: 14.9 to 19.9 percent, depending on the advance provider.

The modest monthly structure makes the Green Card approachable for frequent spenders who want rewards without a high flat annual charge.

Early‑Spend Bonus Campaigns That Boost Point Balances

You can accelerate Membership Rewards earnings through three time‑limited offers triggered immediately after approval. A brief overview clarifies exactly how much to spend and when to do it.

Green Offers™ Card Use Bonus

Earn 150 bonus points per ¥1,000 spent at participating merchants during the first eight months. Capped at 15,000 points for ¥100,000 in cumulative eligible spend, this bonus encourages consistent everyday usage.

Use Bonus 1

Spending at least ¥200,000 within three months of card issuance nets 5,000 extra points, rewarding strategic front‑loaded purchases.

Use Bonus 2

Reaching ¥500,000 in total spend inside six months unlocks 15,000 additional points, ideal for larger upcoming expenses such as travel bookings or electronics.

Stacking these campaigns can generate up to 35,000 bonus points early, giving new cardholders a tangible head start.

Green Offers™: Lifestyle Benefits in Detail

Green Offers™ rounds out the card’s value proposition by turning points into lived experiences rather than merely statement credits. A rapid rundown shows how the program enriches both leisure and routine spending.

- Dining for one person free when reserving selected partner restaurants across Japan.

- Hotel upgrades and discounted nightly rates at curated lifestyle properties.

- Exclusive shopping and cultural events unavailable to the general public, ranging from fashion previews to private art tours.

Because these perks apply year‑round, you can shape weekend escapes, date nights, or family celebrations without waiting for seasonal promotions.

Step‑by‑Step Application Guide

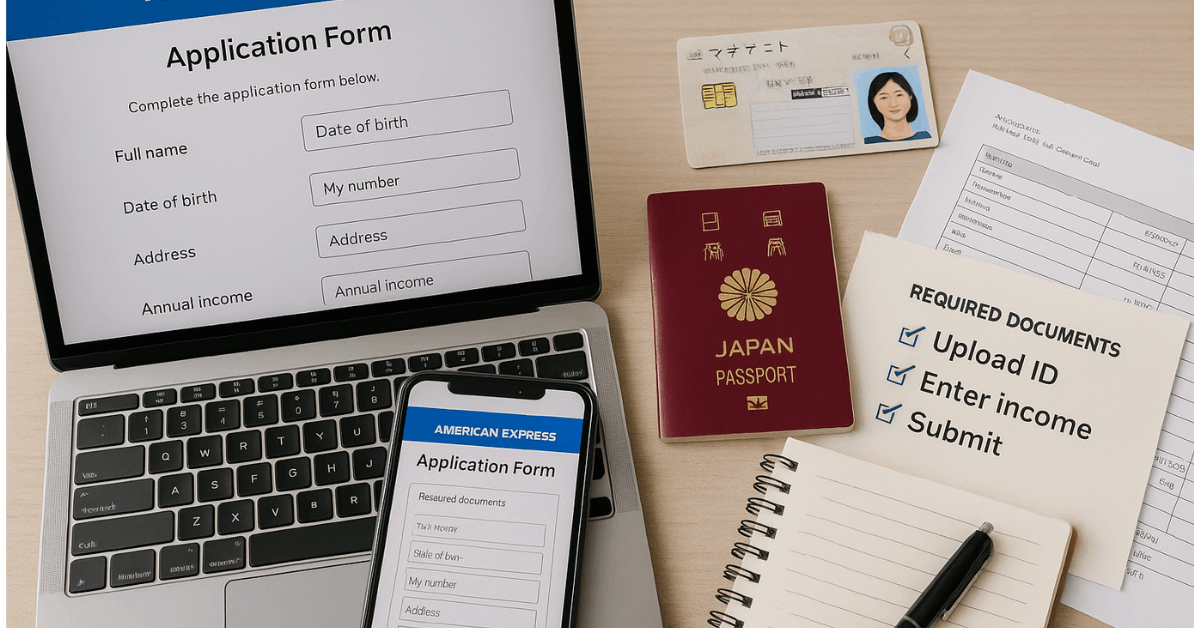

A transparent application process minimizes stress and increases the likelihood of quick approval. Follow each stage carefully, and be ready with documents so progress remains smooth.

1. Enter the Online Portal

Visit the official American Express Japan website, find the Green Card page under All Cards, and press the application button. Secure encryption keeps personal data protected throughout.

2. Complete the Six Application Sections

A single form contains clearly labeled subsections. Work through them methodically:

- Identity Verification – legal name, date of birth, mobile number, and active email.

- About the Applicant – marital status, residence type, years at current address, plus an uploaded passport, driver’s licence, or My Number card.

- Contact Information – street address, phone again, and primary email for official notices.

- Income Details – occupation, employer name, years in position, annual income, and any supplementary earnings.

- Additional Settings – optional ETC card request, paperless billing choice, or service add‑ons.

- Confirmation and Acceptance – review every field, tick terms and conditions, then submit.

3. Post‑Submission Tracking

An on‑screen reception number appears immediately for reference. Screening usually finishes within several business days. Additional verification calls or emails occasionally occur, so keep contact channels open.

Real‑World Considerations Before You Apply

Applying from outside Japan or without local credit history introduces extra variables. Addressing them early prevents surprises during or after approval.

- Credit record – limited history can slow approval, although stable employment and verifiable income may offset scarcity.

- Merchant acceptance – American Express enjoys strong coverage, yet smaller Japanese retailers occasionally prefer Visa, Mastercard, or JCB because of lower fees. Carrying a complementary card safeguards convenience.

- Alternative issuers – applicants struggling with approval can explore bank‑issued JCB cards or multinational issuers offering co‑branded products.

Factoring those points into your decision helps determine whether Green Card benefits outweigh any acceptance gaps in your typical spending region.

AMEX Green vs Gold vs Platinum: At‑a‑Glance Comparison

A direct side‑by‑side look illustrates how each core product targets different lifestyles and spending patterns.

| Feature | Green | Gold | Platinum |

|---|---|---|---|

| Monthly or Annual Fee | ¥1,100 monthly | ¥49,500 annually | ¥165,000 annually |

| Family Card Fee | ¥550 monthly | ¥1,100 monthly | Four free supplementary cards |

| Welcome Bonus Potential | Up to 35,000 points | Often 50,000 + points | Sometimes 100,000 + points |

| Green Offers™ Equivalent | Yes | Expanded version | Luxury tier plus exclusive events |

| Airport Lounge Access | None | Limited domestic lounges | Full Priority Pass™ membership |

| Travel Insurance | Basic | Enhanced | Comprehensive |

| Lifestyle Extras | Free companion dining | High‑end dining and retail | Concierge service, luxury hotel collections |

| Ideal User | First‑time AMEX members seeking value | Frequent diners and mid‑level travelers | High‑income frequent international travelers |

Selecting the Green Card makes sense when you aim for everyday rewards and moderate premium touches at a manageable monthly cost.

Maximizing Membership Rewards Points

Earning points is only half the equation; using them intelligently stretches their value further.

- Transfer points to airline mileage partners when attractive redemption charts appear, often unlocking premium‑class seats for fewer miles than cash would require.

- Pay upcoming travel with points through the AMEX Travel portal whenever seat availability through partners is limited.

- Offset statement charges from Green Offers™ dining or hotel stays, turning experiential spending into partial cash‑back.

- Bundle large purchases during bonus periods to stack campaign points with regular earn rates.

Executing those tactics ensures you benefit regardless of your home country, because most redemption options apply in Japan.

Support Channels for Smooth Card Management

Timely answers during and after application keep finances organized and stress levels low. Store these contacts for quick reference.

- General inquiries (Japanese): 0120‑020120, weekdays 9 a.m.–5 p.m.

- English‑speaking line: 0120‑010‑120, press 2 for support, same business hours.

- Mail correspondence: American Express International, Kamiyacho Trust Tower 20F, 4‑1‑1 Toranomon, Minato‑ku, Tokyo 105‑0001.

Agents routinely help with billing issues, card replacement, dispute resolution, or program clarifications.

Final Thoughts

Choosing a charge card should always rest on measurable value. The AMEX Green Japan Credit Card offers a straightforward monthly fee, respectable earn rates, and a lifestyle program that feels genuinely rewarding rather than ornamental.

New‑member campaigns sweeten the first‑year experience, and a transparent online application means you can secure approval quickly if income and documentation align with issuer expectations.

Disclaimer: This guide provides general information only and does not constitute financial advice. Benefits, fees, and eligibility criteria may change at any time. Always verify current terms on the official American Express Japan website or call customer support before applying.